BPI Personal Loan Review How to Pay? Requirements Approval Loanz

The BPI Personal Loan Calculator is an online tool provided by the Bank of the Philippine Islands (BPI) to help potential borrowers estimate their monthly loan payments. It is easily accessible on BPI's website and only requires the input of the desired loan amount to generate estimates.

Paano Mag LOAN sa BPI Personal, Business & OFW Loan YouTube

Applying for a BPI Personal Loan online can help plan your future as early as now. Borrow up to ₱2 million with no collateral needed and get approved within a week. Plus, pay in flexible installments ranging from 12 to 36 months. Borrow funds up to ₱2 million. Get approved within 5-7 banking days. Pay in 12, 18, 24, 30, or 36 monthly.

PAANO MAGAPPLY NG BPI LOAN ONLINE ONLINE BPI PERSONAL LOAN REGISTRATION 2023 FAST APPROVAL

Salary Loan Application Get information on how to apply for a Personal Loan. View details Disclaimer The maximum annual contractual rate (ACR) is 25.60%. Flexible loan term options from 12 to 36 months. A minimal one-time processing fee of Php 1,500 will be deducted from the loan proceeds.

Complete Guide to BPI Personal Loan Application

BPI Personal Loans help you get extra cash for your different needs—home renovation, education, business, travel, or anything else you need. Features Get a collateral-free loan. Loan any amount ranging from Php 20,000 to Php 3,000,000. Get your cash quickly and safely through your BPI account.

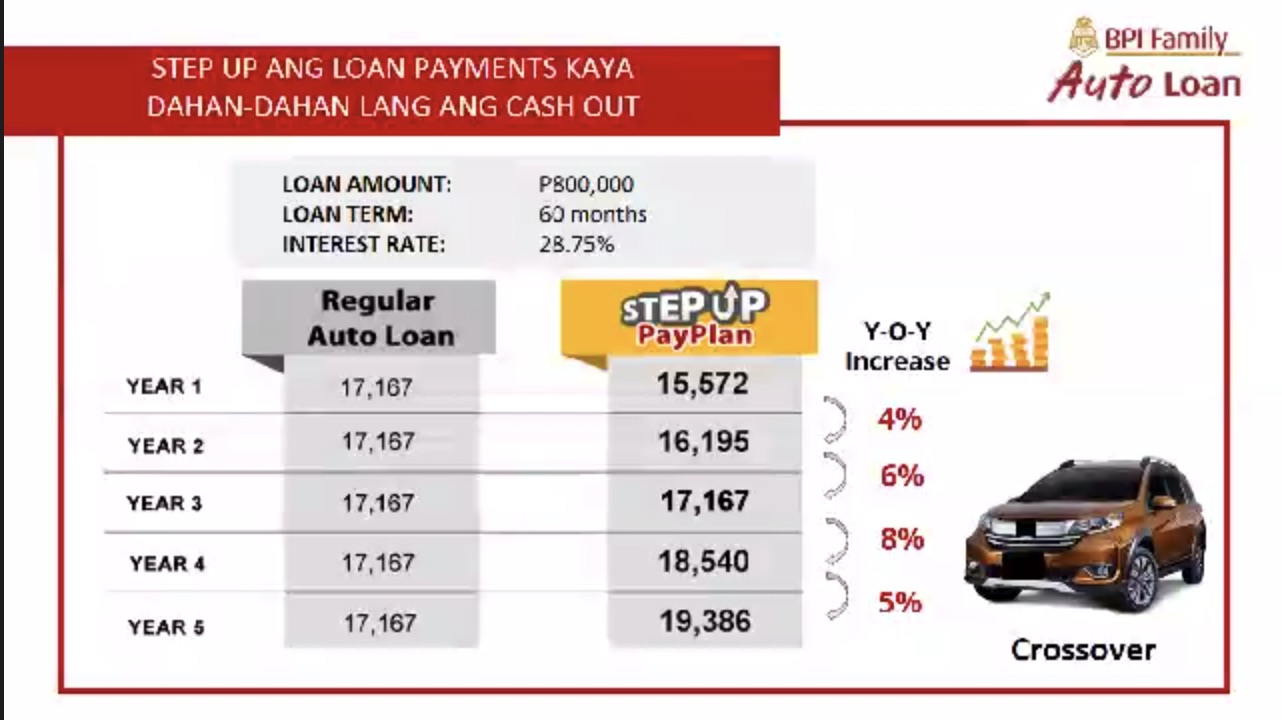

BPI Family Savings Bank launches variableamortization auto and home loan MoneySense Philippines

The BPI Personal Loan is a multi-purpose cash loan. It doesn't require any collateral, so you won't have to pledge anything valuable as a form of repayment. Is the BPI Personal Loan legit? Yes! It's a product offered by one of the leading and most trusted banks in the country, after all. 💸 BPI Personal Loan Types

BPI Housing Loan The Future Homeowner’s Guide

Easy to apply 4.0 / 5 Approval time 4.0 / 5 No hidden condition 3.0 / 5 Renewal rules 4.0 / 5 Service quality 4.0 / 5 Customer support 5.0 / 5 Borrower requirements You must be 18+ Reside in the Ph and have a valid ID Provide proof of your income Have an active checking account Optional Bank account Credit or Debit card Contact information

A Personal Loan Calculator 2022 Cuanmologi

The BPI Personal Loan Calculator provides a convenient way to estimate monthly loan payments. For those who have availed of the loan, payment options include over-the-counter or online transactions. If one wishes to pay off the loan, there are steps to follow to ensure proper closure of the account. Non-payment or insufficient funding of the.

THOUGHTSKOTO

Personal loans Your dream car, house, or vacation is within reach with BPI loans. Find a loan for you Our loans are designed with your needs and goals in mind. Personal loans Useful and affordable—no collaterals Auto loans Make that dream car yours Housing loans Welcome a new life with a new home Promotions Say yes to discounts and perks

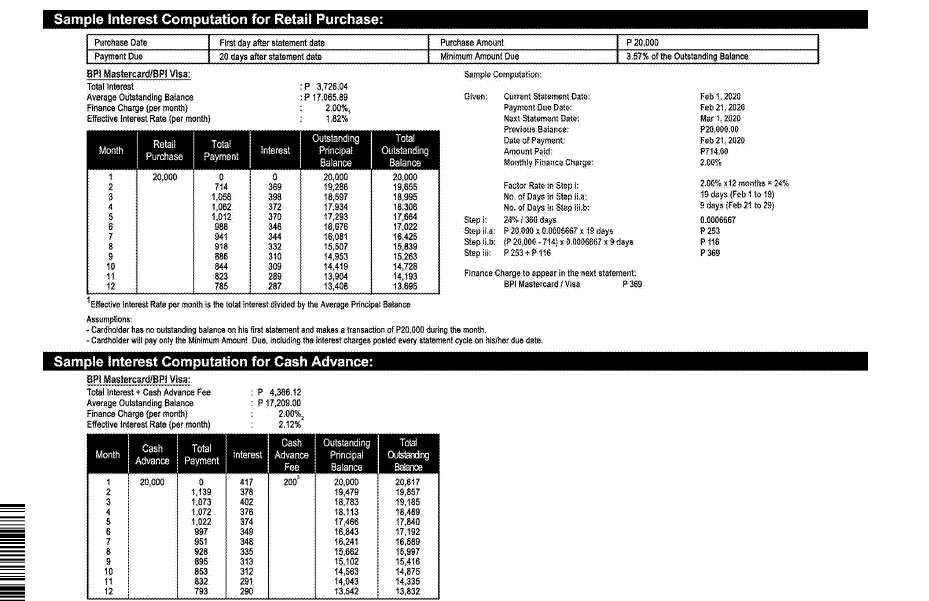

BPI Credit Card Which is better between Finance Charge and SIP Loan?

BPI Personal Loan helps you get extra cash for your different needs - home renovation, education, business, travel, or anything else you need. Apply online now.

BPI Personal Loan Your Emergency Financial Best Friend

Apply at your convenience through this link or through your nearest branch. For other inquiries, you may call (02) 889-10000 or email us at [email protected]. Please also make sure to submit your application form together with the complete requirements.

Printable Amortization Schedule Personal Loan Printable World Holiday

BPI Personal Loan Calculator is a tool that helps clients to calculate their monthly loan payments and estimate the total interest and fees charged on their loans. The calculator is easily accessible below, and it is very simple to use, requiring only one basic piece of information, the desired loan amount.

How to Apply for BPI Personal Loan (with List of Requirements) It's More Fun With Juan

The BPI Personal Loan Calculator takes into account the add-on monthly interest rate of 1.2%, and the maximum annual contractual rate (ACR) of 25.60% while computing the monthly installments. It is important to note that the actual monthly installment amount may vary based on prevailing rates when the borrower applies for a BPI Personal Loan.

How to Get a Loan From BPI in 2023 Requirements and Process

The estimated monthly amortization is Php 1,907 with ACR of 25.60%. Compute for your loan here. For inquiries and comments, send us a message or call our 24-hour BPI Contact Center at (+632) 889-10000. BPI is regulated by the Bangko Sentral ng Pilipinas (https://www.bsp.gov.ph).

BPI BANK PERSONAL CASH LOAN FOR OFWS, 710 DAYS APPROVAL, 3X YOUR SALARY

Step 1: Login to your BPI Online account. The first step in tracking your BPI personal loan progress is to login to your BPI Online account. This will give you access to all the information and updates regarding your loan. Once you are logged in, navigate to the "Loans" section.

Loan Calculator Templates 15+ Free Professional Docs, Xlsx & PDF Formats, Samples, Examples,

Make your dreams come true today. With BPI's personal loan application, you can get extra cash for your different needs! Find out how to get started right here.

List of BPI Personal Loan Offers You Can Apply For It's More Fun With Juan

Personal Loans. A multi-purpose cash loan with affordable payment terms and no required collateral. learn more. Auto Loan. Turn your dream car into a reality through BPI Auto Loan's reliable and hassle-free product solutions. learn more. Housing Loan. Planning to buy a home? Turn your dream into a reality with BPI Housing Loan. learn more.